| LOVE IS BLIND |

We fell hopelessly in love with this quote at first sight. "Once again, 'average' is not a useful term when describing the wine business. You need to look below the surface because what you see on top belies risks that lurk in the depths." It comes from the opening paragraphs of Silicon Valley Bank's once-a-year review and predictions for the U.S. wine business in 2017.

This in-depth report charts these hidden currents assiduously—unless they're chasing will-o-the-wisps like credit default swaps, bankers are nothing if not careful—uncovering for us the co-existence of many contradictory trends in this large, complex market. It made us think of rip tides, the attention arresting crash of the surf masking an unseen but powerful outward flow beneath.

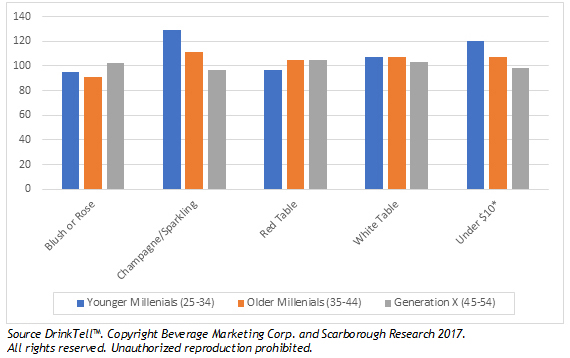

With full-market 2016 wine market data now widely available we noted several areas where strategists will benefit from comparing emerging trends with DrinkTell™ and other big data sources. These range from the all-important demographic shifts both shaping and predicting the market, to price tiers heavily impacted by a host of complex factors. Reformulated panel numbers in index chart below from Scarborough (sourced from DrinkTell™) confirm partial market analyses. Millennials drink cheaper and really like bubbly. |

Comparative Purchase Preferences

Millennials and Gen X

|

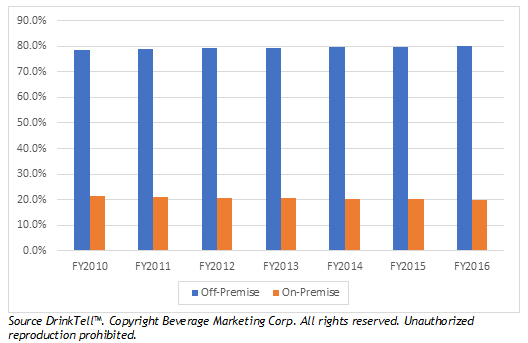

A lot of recent press and prognostication has touched on the woes of the restaurant industry. This is not new news as far as casual theme concepts are concerned but the apprehension that the slide is irreversible is new. Research on the nature and impact of prepared take-out appears to confirm that. And there is data that shows on-premise wine sales sliding. But here's what we find in DrinkTell™—virtually no change in on/off share when we look in the rearview mirror. |

Table Wine Volume Share On/Off Premise

|

What we think is happening is that the wine market is so big (and so much of it is missed by any partial market analysis) that the big picture is the hidden undercurrent.

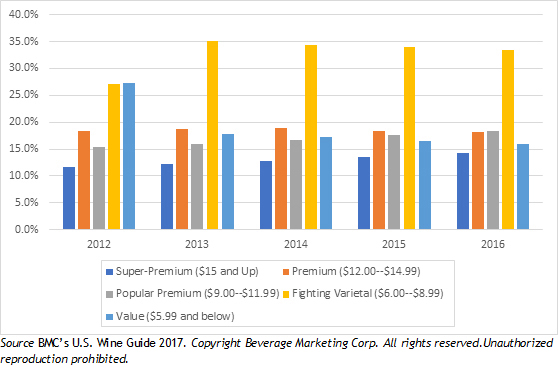

Finally, we touch on a critically important but at least partially shady area in the data-share of volume by price tier. Data from all sources, including DrinkTell™ clearly support the collapse of the jug wine market over the past four years and the rise of heavily marketed "consumer |

Share of Volume by Price Tier

|

solution" oriented packaging (Tetra Pak and Bota Box). But much is still murky. Our data, just published in our BMC's U.S. Wine Guide 2017 shows popular premium (read Millennial favorite) growing and super premium growing with the fighting varietal category, which some analysts think will fade away in the face of heavy brand marketing, still hanging on with a significant share of the market.

As much as we've tried to squeeze into this issue of DrinkTelligence, it's just the foam on a whitecap compared to a dive into the actual data. For questions or to take a look at our DrinkTell™ online database yourself just give us a call. To order a BMC U.S. Wine, Beer, or Spirits Guide, click below. |