The infographics below are derived from data contained in

BMC's DrinkTell™ Database with Market Forecasts

|

|

| We delayed June's Monthly DrinkTelligence until after the 4th of July Holiday. We didn't want you to miss it! |

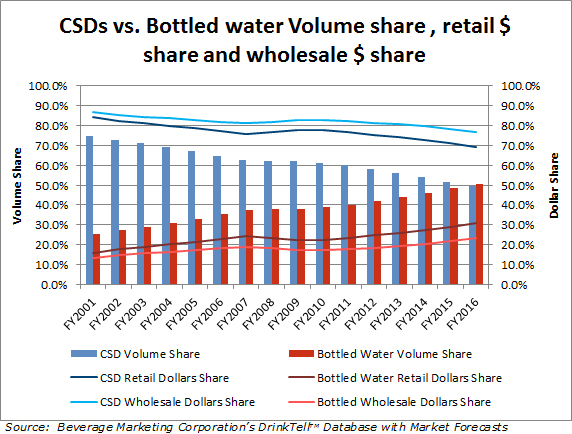

CSDs vs. BOTTLED WATER - A VIEW FROM THREE VANTAGE POINTS

BMC's DrinkTell™ Database Examines Volume vs. Wholesale and Retail Dollar Trends |

The beverage landscape has changed significantly in the new millennium, according to Beverage Marketing's DrinkTell™ database. This is most easily seen when one compares and contrasts the two largest packaged beverage categories - bottled water and carbonated soft drinks (CSDs) - in terms of annual volume from 2001 to 2016. In 2001, CSDs were nearly three times the size of bottled water and enjoyed a seemingly insurmountable 9.9-billion gallon advantage. However, proving that nearly anything can change in time, CSDs have declined from 15.1 billion gallons in 2001 to 12.5 billion gallons in 2016, while bottled water has grown from 5.2 billion gallons to 12.8 billion gallons in the same 15-year time frame.

According to DrinkTell™, the storyline is not as glamorous when measured by wholesale dollars. Here, the more expensively-priced CSDs clearly maintain their lead over bottled water. Nevertheless, as to be expected, the share gap between CSDs and bottled water has narrowed in the period spanning the beginning of the Bush administration and the end of Obama's. In 2001, CSDs constituted 86.5% of the combined beverages' wholesale dollar sales; by 2016, that had slipped to 76.7%. Correspondingly, bottled water's share of wholesale dollars grew from 13.5% to 23.3% in the 15-year period. |

|

In contrast to wholesale dollars, the shift in retail dollar share between CSDs and bottled water is more pronounced. Sure, CSDs still dominate from a retail dollar perspective, but their share has dwindled from 84.3% in 2001 to 69.3% in 2016. In contrast, bottled water's share of retail dollars has nearly doubled from 15.7% to 30.7%. Put another way, retailers' margins have been able to expand in bottled water but not in CSDs. Much of this has to do with channel and product mix, with higher-priced segments such as sparkling and imported water being able to command a higher price in on-premise outlets. We believe this is one example of how the recent addition of retail dollars to the DrinkTell™ database can help the user to analyze the beverage market in deeper ways.

DrinkTell™ offers a broad range of measures from volume, wholesale and retail dollar category and sub-category data, company and brand sales figures, consumer insights, ad expenditures and much more. DrinkTelligence readers are invited to contact Charlene Harvey at charvey@beveragemarketing.com to request a web-based demo or to visit https://www.beveragemarketing.com/drinktell.asp for details. |

|

|